lv income protection key features LV='s document library lets you download, save and email files - directly to you and your clients. Find key information, product profiles and more here. Current status. Active. Lithuanian headquarters. Previous logo used from 2014 to 2020, and Latvia in 2021. Delfi (occasionally capitalized as DELFI) is a news website in Estonia, Latvia, and Lithuania providing daily news, ranging from gardening to politics. [1]

0 · lv income protection for doctors

1 · lv income protection for advisers

2 · lv income protection contact number

3 · lv income protection claim

4 · lv income protection calculator

5 · lv income protection application form

6 · lv income protection additional benefits

7 · lv for advisers underwriting limits

Rīga, Berģi , Siguldas šos. 6. Daugavpils , Stacijas 129k. Jēkabpils , Kļavu 1. Valmiera , Matīšu šos. 6. Liepāja , Zemnieku 22. Klientu atbalsta centra tālrunis: 67 202 010. Klientu atbalsta centra e-pasts: [email protected]. Saplāno maršrutu! Veikalu-noliktavu DEPO darba laiki un kontaktinformācija.

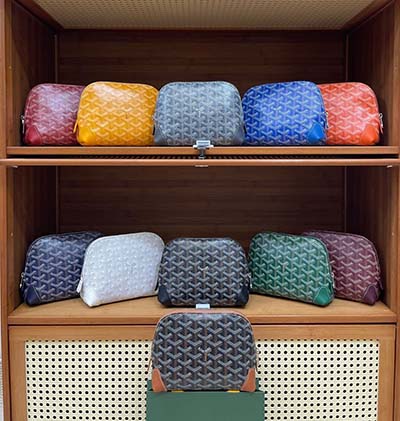

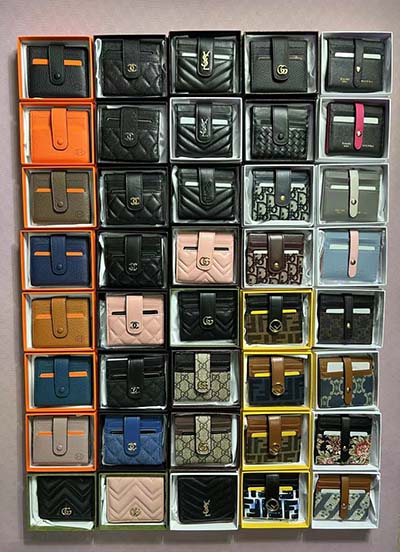

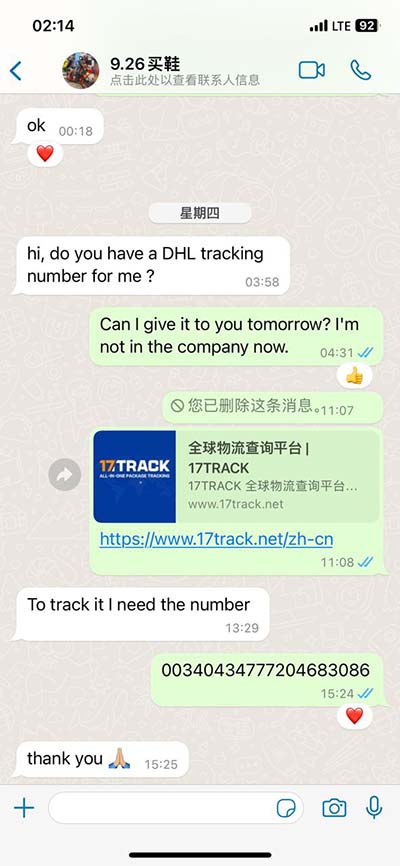

replica designer baby clothing

LV=’s Income Protection supports your client if they can’t work because of illness or accident. Compare the features and cover options here.LV='s document library lets you download, save and email files - directly to you and .

Our Income Protection gives your client a helping hand. So if they’re unable to .See a full list of Income Protection cover features. If your client becomes sick or . LV='s document library lets you download, save and email files - directly to you and your clients. Find key information, product profiles and more here.See a full list of Income Protection cover features. If your client becomes sick or injured and is unable to work, they’ll receive a monthly benefit of up to 60% of their income – up until they’re able to get back to work or their claim period ends.

replica clothing uk paypal

Our Income Protection Insurance can be used to protect your monthly rent and living expenses if you can't work because of a long-term illness or accident. This gives you the financial reassurance that you’ll be able to continue to make .Income protection insurance’s primary feature is a tax-free monthly payment to help replace your income, paid to you after your chosen waiting period. The payments will usually be up to 50 .Income Protection is designed to pay you a regular income if you are unable to work due to sickness or accident. See all our Income Protection FAQs for more information.Our Income Protection gives your client a helping hand. So if they’re unable to work, we’ll pay a monthly benefit to keep them afloat. Find key information to help you make a thorough comparison:

In this Key Features document we try to help you, by giving you the key features of the Income Protection and Budget Income Protection Policies, available in our Flexible Protection Plan.LV= income protection key features. Pays out up to 60% of your income. Monthly payments are tax-free. Will cover you for accident and sickness that leaves you unable to work. Choose from comprehensive or budget cover.

We aim to provide the best experience possible. That's why we have an extensive Income Protection FAQ page ranging from general to claim and cover guidance.Income protection insurance is designed to pay you a regular income, to help replace some of your earnings if you are unable to work due to sickness or accident, whether you’re employed or self-employed. It can be used to help support you and/or your family’s current lifestyle and financial commitments whilst unable to work.Budget Income ProtectIon Key Features of the Flexible Protection Plan The Financial Conduct Authority is a financial services regulator. It requires us, LV=, to give you this important information to help you to decide whether our Flexible Protection Plan is right for you. You should read this document carefully so that you understand what you areFocusing on small businesses who typically can’t access Group Protection, LV= Executive Income Protection covers the cost of providing monthly sick pay benefits to a key employee. If an employee is unable to work due to illness or injury, the employer can make a claim, and uses the payments to provide sick pay to their employee (via PAYE) in .

That's why we have an extensive Income Protection FAQ page ranging from general to claim and cover guidance. Menu. Insurance; Life, Investments, Pensions and Retirement; Menu. . LV= TIP; LV= Smoothed Bond; LV= Smoothed Pension; LV= General Investment Account; LV= ISA Portfolio; LV= Pension Portfolio; LV= Junior ISA Portfolio; Fund prices; RNPFN;Executive Income Protection – take a look at the key features to see how it can meet your client’s needs. LV= Personal. LV= Adviser. Executive Income Protection: Download documents. Quote & Apply. Servicing. . LV= Executive Income Protection is designed for small and medium businesses to cover the cost of providing sick pay benefits to an .

LV=’s Personal Sick Pay – at a glance gives you an overview of the features. . Income Protection; Life and Critical Illness; Life Protection; Personal Sick Pay; Family Income Benefit; Gift Inter Vivos; . Our Personal Sick Pay cover has two options – we’ve listed the key information here, so you can easily explain the differences to .

Main features of Relevant Life cover Knowing your client is protecting the interests of their most important business asset – their people - will help set your their mind at ease. The death-in-service benefit pays out to the employee’s family or dependants who rely on them financially.For further information about our products and services available through LV= Platform Services, please speak to your financial adviser. Alternatively, you can speak to our Customer Service Team on 0800 032 9357, or email [email protected].. .Income protection insurance’s primary feature is a tax-free monthly payment to help replace your income, paid to you after your chosen waiting period. The payments will usually be up to 50-60% of the income (before tax,) that you received before your injury or illness.Key Person Income Protection; Share Protection; Business Loan Protection; Relevant Life Plan; . Cover for a lower premium, which increases each year with age. Shares many of the features and benefits of Income Protection Benefit. Key documents and tools . . Level cover: £10,000 a month/£120,000 a year; Increasing cover: £7,000 a month/£ .

Business Protection Insurance from LV= assists in safeguarding your business’s financial future. Speak to LV= today about Business Protection today. . Business Protection: Key Person cover. Length: 1min 32sec. Watch the video 'Business Protection: Key Person cover' . Executive Income Protection allows you to continue paying your key .LV=’s video and webinar library features protection guidance, with updates on our products, how to use Fastway and CPD qualifying webinars. . LV= Income Protection Solutions . Explore how businesses can survive if a key person in the business dies, or becomes seriously ill with the support of Key Person Cover.Executive Income Protection This is designed for small businesses to cover the cost of providing sick pay benefits to a key employee – including salaried directors. Set up by the business, it pays out a monthly benefit to the employer who then passes it to the employee via PAYE, with optional cover for employer’s pension scheme .

If your client chooses cover of less than £3,000 a month, we’ll pay the level cover they chose – minus any income they’re still getting. We won’t deduct anything if your client receives state benefits – but payments from this policy might affect eligibility and . LV='s income protection insurance will cover up to 60% on a personal plan of your annual income before tax maximum benefit of £12,500 per month. If you own a limited company, your payment can also include .

Income Protection key features (1.2 MB/pdf) Income Protection terms and conditions (781.6 KB/pdf) Income Protection brochure (3.9 MB/pdf) Income Protection benefits summary (250.5 KB/pdf) Income Protection select (95.1 KB/pdf) Reasons why paragraphs - Income Protection (310.3 KB/pdf) Zurich Accelerate policy wording document (2.1 MB/pdf)Covers 87* conditions – a full list can be found in the Business Protection key features document. Enhanced claim payments for 17 conditions. Flexible cover options – level, inflation-linked or decreasing cover.Our Income Protection solutions overview video offers key information on our Income Protection product offering including Income Protection, Personal Sick Pay, Executive Income Protection and any additional special features. . Find out more about why you should choose LV= when recommending Income Protection to your clients including features .

LV= Executive Income Protection is designed for small and medium businesses to cover the cost of providing sick pay benefits to a key employee. . Key features of Executive Income Protection. Knowing your client is protecting the interests of their most important business asset – their people - will help set their mind at ease. .Our Income Protection can help your clients rest a bit easier, knowing they'll get a monthly income if they're sick or injured and can't work. Your clients can choose between level or increasing cover, they can select the length of their deferred period, and choose how long they want their cover to pay out for.

lv income protection for doctors

Overall, UK customers of LV= are happy with their Income Protection policies and would recommend them to others. The pros and cons of Liverpool Victoria (LV=) Income Protection. Pros: - LV= offers a range of income protection policies that provide cover up to 75% of your income if you becomeKey Features of the LV= Flexible Protection Plan The Financial Conduct Authority is a financial services regulator. It requires us, Liverpool Victoria Financial Services Limited (LV=), . y Income Protection will pay you a regular monthly income, to help replace some of the income you would lose if you can’t work through sickness or an accident.Income Protection; Business Protection; Life Protection advice; Trusts; Guides; Existing customers . LV= ISA; LV= TIP; LV= Smoothed Bond; LV= Smoothed Pension; LV= General Investment Account . part, depend on your personal tax status, which may be subject to change. Please refer to the Key Features for details of how contributions and .

Before purchasing a fixed term annuity, you can take up to 25% of your pension pot as tax-free cash. Any payments from your annuity after this will be taxed as income. Much like a salary – if your total income, including your annuity income, goes above your personal income tax allowance, the money will be taxable.Check your client’s suitability with the key features, at a glance. LV= Personal . ** Except where Waiver of Premium is added to a LV= Flexible Protection Plan which includes an Income Protection or Personal Sick Pay policy. In which case, the Waiver of Premium policy will adopt the waiting period the client has chosen for Income Protection .

Key Person Income Protection; Share Protection; Business Loan Protection; Relevant Life Plan; Umbrella Benefits - Protection navigation ; Umbrella Benefits; . Key Features. Posters. Product Details. Product Information. Product Summary. Proposal Forms. Sales Aid. Sales Aid - Protection Matters. Servicing Forms.Consolidation of their three income protection policies into one comprehensive policy; Vitality income boost - A feature which allows customers to increase their pay out by an extra 20% for up to 6 months by keeping active and improving their Vitality status; Enhanced guaranteed insurability - Members can easily make changes to their policy without providing additional .

lv income protection for advisers

lv income protection contact number

183 Dennys jobs available in Las Vegas, NV on Indeed.com. Apply to Cook, Restaurant Manager, Host/hostess and more!

lv income protection key features|lv income protection contact number